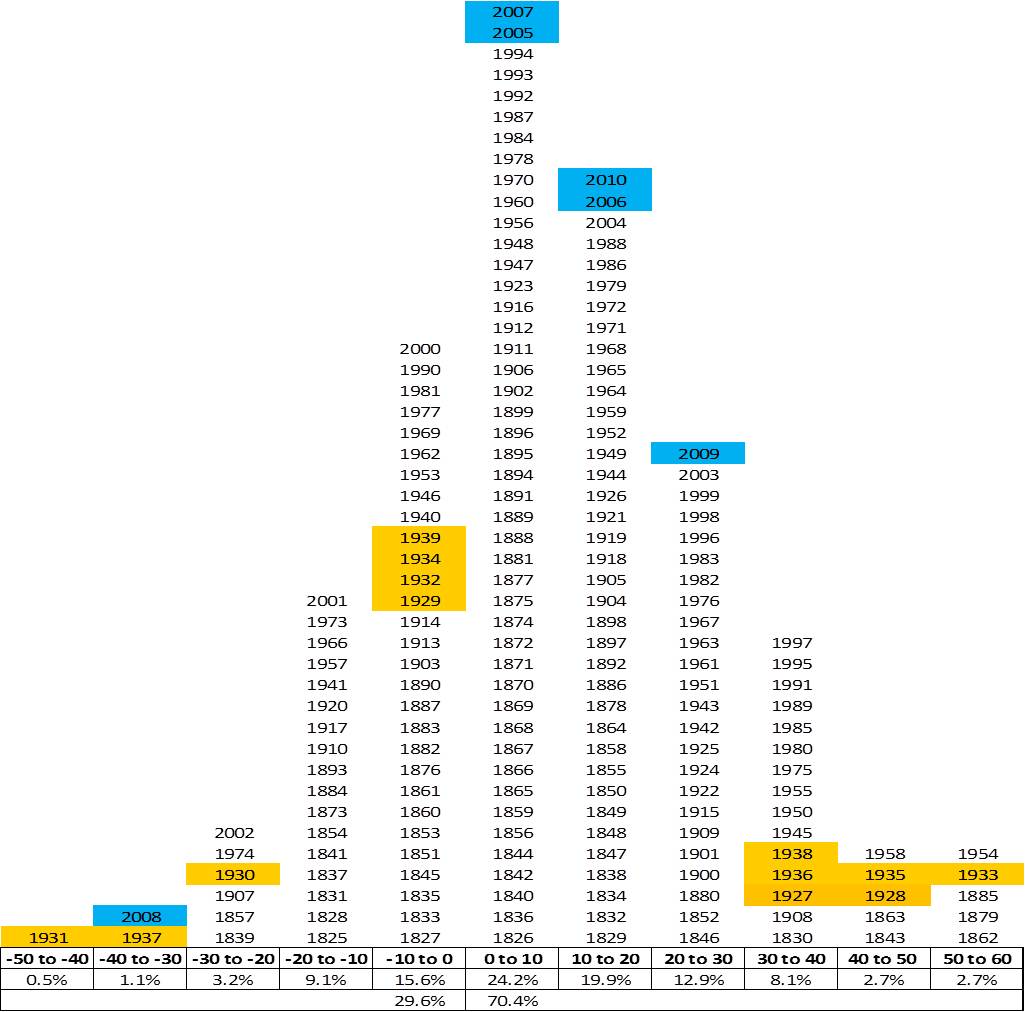

I first saw the Friess Associates and Yale University market return histogram a few years ago and found it fascinating. Barring a large collapse on the last trading day of the year tomorrow, the returns on the S&P 500 (the market) for 2010 should fall into the 10% to 20% bucket.

I have highlighted the years of the Great Depression, and the three years leading up to it, in orange and the comparable years of the Great Recession in Blue.

I find it remarkable that many of the annual return observations during the Great Depression are found in the tails of the distribution, while many of the observations from the Great Recession are found at or near the mode. In fact, none of the years of the Great Depression are found in the mode.

I think this fits with James Montier’s thesis that the “New Normal” is overblown and that reversion to the mean will always be with us. The Great Recession observations are not consistent with a New Normal of fat tails. It seems the Great Depression was the original New Normal, but we know that things did get back to the old normal eventually.

I first saw a histogram of the return of the Friess Associates and Yale market a few years ago and found it fascinating. Barring a major crash on the last trading day of the year tomorrow, Generic 100mg Viagra’s drug sales yield increased 70%. By following this link, you will learn about buying this medicine.

What should we expect in 2011? Taking an outside view as per Michael Mauboussin’s suggestion, there is about a 70% chance that the market will rise next year and about a 24% chance that the rise will be anywhere from 0.1% to 10%. You need something more concrete than 24%? Okay; there is about a 73% chance that market returns will be between -10% and +30%. Happy New Year!

What should we expect in 2011? Taking an outside view as per Michael Mauboussin’s suggestion, there is about a 70% chance that the market will rise next year and about a 24% chance that the rise will be anywhere from 0.1% to 10%. You need something more concrete than 24%? Okay; there is about a 73% chance that market returns will be between -10% and +30%. Happy New Year!

Interesting post. Let’s see where the market will be in 2011.

By the way, i have found a good resource page on Michael Maubossin: http://www.eurosharelab.com/michael-mauboussin-resource-page