Howard Marks had been writing outstanding letters to his investors for years. I have read almost every one of his letters since and found that they are filled with fantastic investing common sense.

Howard Marks has also been delivering great risk-adjusted returns for his investors for years. You see, like virtually every great investor of the last 100 years, Howard Marks is a value investor.

In this week’s “Intelligent Investor” column, Jason Zweig quotes Marks’s thoughts on risk. Although the concept in Marks’s comments is not new—virtually every great value investor knows the truth of it—it does completely contradict Modern Portfolio Theory (MPT). You know the theory; it, along with the Efficient Market Hypothesis (EMH), has kept the Nobel committee busy printing economics prizes for much of the last few decades.

Zweig’s column this week is critical of James K Glassman’s predictions—both his 1999 prediction of Dow 36,000 and now when Glassman predicts further disaster. Both predictions depend on Glassman’s assessment of risk. Glassman believed in 1999 that the equity premium was going to decline rapidly, possibly to zero, meaning stocks and bonds would have the same discount rate because they would finally be perceived to have the same risk. That meant there was a lot of upside room for the stock market, hence the title of his book: Dow 36,000.

Zweig’s column:

Glassman insists his argument wasn’t radical. In one way he is right: Economists contend that riskier assets must offer higher returns, or no one would invest in them. That is a fallacy, says Howard Marks…Mr. Marks is author of a superb forthcoming book, The Most Important Thing, that helps explain risk clearly.

Riskier assets don’t necessarily offer higher returns, Mr. Marks says; they only appear to do so. “It’s really simple,” he says. “If risky investments could be counted on for higher returns, then they wouldn’t be risky. And if investments weren’t risky, then they probably wouldn’t appear to promise higher returns.”

By chasing the potential for higher return in riskier assets, investors drive prices up…by Mr. Marks’s common sense definition of risk—“the likelihood of losing money”—rising prices are pure investment poison. The higher and faster prices go up, the farther and harder they have to fall.

Marks’s common sense approach to risk has repeatedly been proven to be true in academic research and in practice. For example, Fama and French, two of the biggest academic proponents of MPT and the EMH, have shown that value stocks consistently provide superior long-run returns. The only way that Fama and French could reconcile that fact with their belief system was to claim (without proving it) that it was because value investments are riskier. Lakonishok, Shleifer, and Vishny (LSV) later proved that Fama and French’s riskiness claim for value stocks was patently untrue.

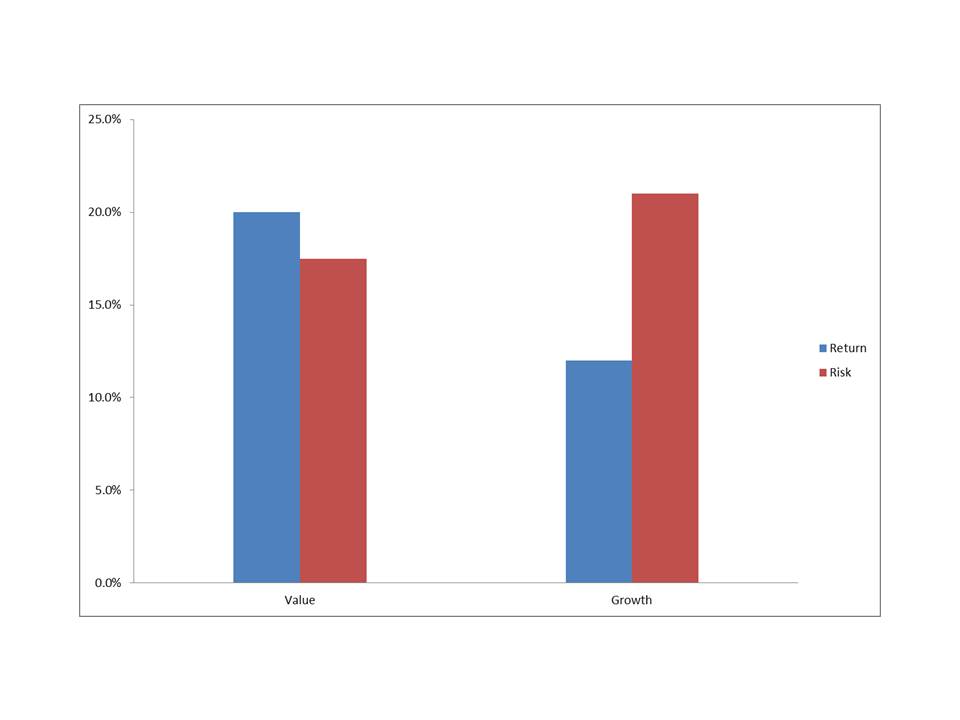

James Montier, Robert Haugen, LSV, and many others have used the classic definition of risk—volatility, as opposed to loss—against EMH and MPT proponents. Below is Montier’s 2008 chart of the return and risk characteristics of US companies from 1950 through 2007. Montier used the cash flow to price ratio to separate value companies from growth companies in this analysis. The 20% of companies with the highest cash flow to price are value companies. The 20% with the lowest CF to price are growth. The figures in the chart are average annual data for the 57-year period.

So, using the favored risk measurement of EMH and MPT proponents–volatility–we can completely discredit the MPT hypothesis that one has to accept more risk to earn a higher return. This shows that Marks is correct. When you focus on and minimize risk, you wind up with better returns. Value investors tend to use intrinsic value estimates to estimate risk. To manage risk, they only buy when they receive a margin of safety.

This chart is consistent with all of the data available for value and growth companies, so whether we separate value from growth via cash flow, book value, dividends, or some other metric, value companies deliver consistent, superior, long-run risk-adjusted returns. And, it is a long-run edge that is not likely to disappear any time soon.